Why Crop Insurance Claims Are Rising

Crop insurance claims are climbing fast across the U.S., fueled by a combination of extreme weather events, rising input costs, and expanded federal coverage options. From widespread droughts to heavy rains and hail, more farmers are leaning on insurance as both a safety net and a strategic necessity. This surge in claims is reshaping how risk is managed across the ag industry—and exposing deeper financial and environmental challenges in the process. Here’s a closer look at what’s driving the trend and what it means for farmers, insurers, and rural communities.

Here is a summary of what we will cover:

- Crop Insurance Facts & Trends

- Key Drivers Behind Rising Crop Insurance Claims

- Impact on Stakeholders

- The Role of Climate

- Mitigation & Future Outlook

Crop Insurance Facts and Trends

Before we dive into the causes behind rising crop insurance claims, it’s important to understand how the things have grown and shifted in recent years. From record-setting payouts to expanding coverage areas, the numbers reveal just how much the landscape has changed.

Insurance Liabilities & Payout Ratios (2024)

- Total crop insurance liability (the value insured) in 2024 was $158 billion, with 7% resulting in indemnity payments, suggesting around $11.1 billion paid out so far in 2024.

- According to USDA’s 2022 Census, overall cropland coverage under crop insurance rose by about 9% from 2017 to 2022, with mid-sized farms (70–100 acres) jumping by over 20%.

Record-Breaking Payouts

- Between 2001 and 2022, total indemnity payments reached approximately $161.6 billion, averaging $7.7 billion annually.

- 2022 alone set a new record with $19.13 billion in crop insurance payouts (up from $2.96 billion in 2001).

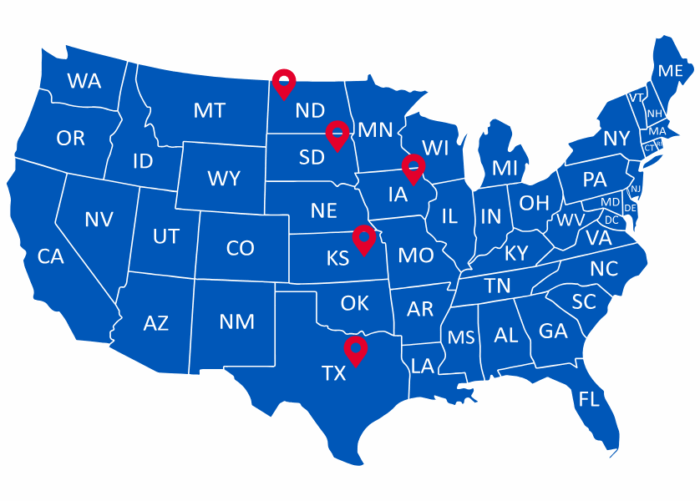

Geographical & Commodity Concentration

- Just 10 states received 65% of payments between 2001–2022—most notably: CA, IL, IA, KS, MN, MO, NE, ND, SD, and TX.

- Three states—Kansas, North Dakota and Texas—received $48.2 B, nearly one-third of all payouts.

- Four main crops—corn, soybeans, wheat, and cotton—accounted for 75% of indemnities, with corn alone receiving ~$55.6 B (~34% of total).

Top 5 States With Highest Crop Insurance Indemnities (1995-2022)

These top 5 states accounted for 42% of all crop insurance payouts.

Average Payout Per Operation

- In 2022, the average insurance payout per operation was $52,819, a 41% increase from $37,388 in 2017 (though still down from the 2012 peak of $65,088).

- About 6% of U.S. farm operations (107,409 farms) received insurance payments in 2022.

Takeaway: The scale and scope of crop insurance have expanded dramatically—more acres covered, more dollars paid out, and more frequent claims driven by unpredictable weather. These trends signal a system under pressure and set the stage for understanding what’s driving the surge.

Key Drivers Behind Rising Crop Insurance Claims

Understanding the surge in crop insurance claims means looking beyond the numbers. A mix of environmental, economic, and policy-related factors is fueling the increase—each playing a critical role in how and why farmers rely more heavily on insurance today.

At a Glance: What’s Driving Higher Crop Insurance Claims?

| Driver | Impact on Claims |

|---|---|

| Extreme Weather | More frequent/severe drought, flooding, heat events = more frequent and larger losses. |

| Policy Expansion | New options (e.g., WFRP, specialty crops, controlled-environment) = broader eligibility. |

| Rising Input Costs | High costs increase financial risk = more farmers enroll for protection. |

| Subsidy Structure | 60%+ premium subsidies + insurer guarantees = increased participation. |

| Farmer Behavior & Incentives | Subsidies lower risk signals = reduced urgency to adapt, more claims in high-risk areas. |

The Causes

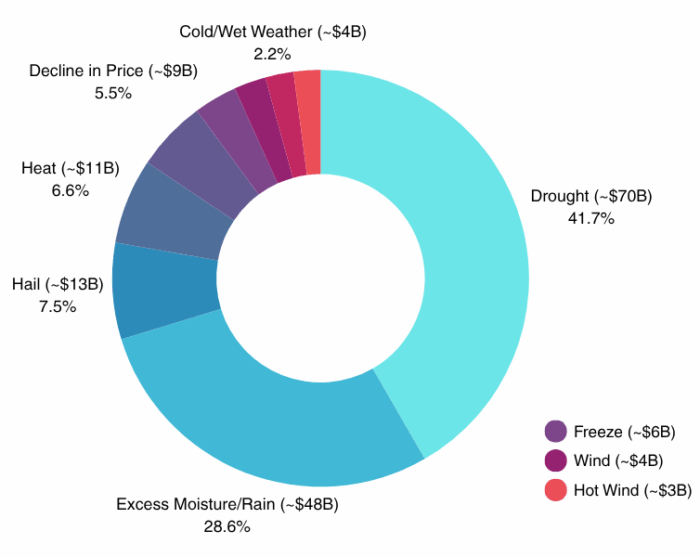

Extreme Weather Is the Leading Cause

- Weather-related events (drought, floods, heat, hail) caused ~80% of indemnities from 2001–2022.

- Climate volatility has already added $27 billion to payouts (1991–2017) and could double losses in high-risk crops like maize by mid-century.

Expanded Policies Leads to More Claims

- Whole-Farm Revenue Protection (WFRP) saw $21.1 billion in indemnities in 2023—its highest ever.

- Specialty crops and indoor ag coverage expanded 34% since 2016, with pilot programs now active in 18 states.

Economic Pressures Push Farmers Toward Insurance

- Fertilizer, diesel, and seed prices have spiked in recent years, tightening margins.

- Farmers now use insurance to protect their working capital, especially in regions where weather volatility is rising.

Government Subsidies Make Coverage Attractive

Behavioral Incentives Slow Risk Reduction

- Studies show that generous subsidies lead to “elastic demand”—farmers are more likely to insure, even in high-risk or marginal areas.

- Because insurance absorbs financial shocks, farmers may delay adopting costly but resilient practices .

Top 9 National Causes of Loss With Largest Indemnity Payments (1995-2024)

Takeaway: Rising crop insurance claims aren’t the result of one factor—they’re the product of mounting climate risks, expanding policy options, economic pressure on farmers, and a heavily subsidized system that encourages widespread participation.

Impact on Stakeholders

The rise in crop insurance claims doesn’t just affect farmers—it ripples through the entire agricultural ecosystem. From how producers make planting decisions to how insurers manage billion-dollar liabilities, the impacts are reshaping risk, resilience, and revenue across the board.

Farmers: Economic Cushion & Dependency Risks

- Income Stability: Studies show that indemnities reduce short‑term debt reliance and smooth farm income in volatile seasons.

- No Guaranteed Expansion: More insurance doesn’t necessarily lead farmers to take on more debt—liability doesn’t significantly change total farm debt levels.

- Changes in Production Strategy: Some producers adjust crop choices, input levels, or harvest timing based on insurance eligibility—sometimes boosting yields, other times increasing exposure or costs.

Insurance Industry: Growth, Profit, & Risk

- Guaranteed Margins: Private insurers receive administrative cost reimbursements and retain underwriting gains capped by the government.

- Large Liabilities: With liabilities over $100 billion, insurers face elevated risk exposure—particularly during consecutive adverse-weather years.

Pro Tip: West Side Salvage helps reduce long-term vulnerability through proactive silo maintenance, emergency response, and salvage services. Their Emergency Action Plan (EAP) support also helps farms prepare before disaster strikes—minimizing downtime and financial risk.

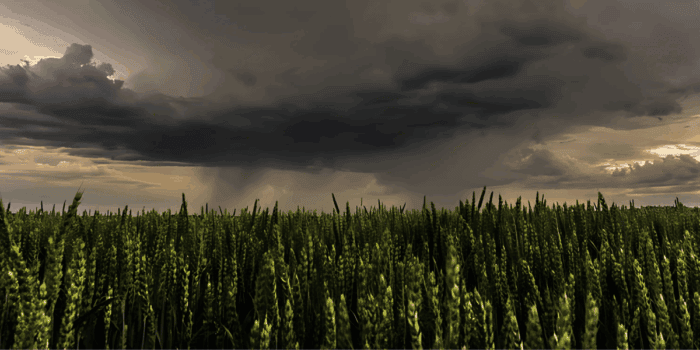

The Role of Climate

Weather patterns are becoming more unpredictable—bringing longer dry spells, more intense storms, sudden frosts, and record-breaking heat. For farmers, these shifts aren’t just seasonal concerns—they’re ongoing operational risks. Crop insurance claims reflect this reality, with weather-related causes like drought, excess moisture, hail, and extreme heat consistently ranking among the top reasons for losses.

Unpredictability Is the New Normal

Farmers today aren’t just planning around typical seasonal swings—they’re navigating conditions that swing rapidly from one extreme to another. A field that’s too dry to plant one year may be flooded the next. These shifts can wipe out entire harvests or make crop planning incredibly difficult.

- For example, from 2001–2022, drought alone accounted for over $56 billion in crop insurance payouts, while excess moisture caused nearly $40 billion in losses.

- Recent years have seen significant increases in both heat-related and flood-related claims, particularly in the Midwest and Southern Plains.

Insurance Isn’t Designed for This Kind of Volatility

The crop insurance system was built on historical patterns. But as those patterns shift, the system is under pressure. Shorter rating periods and evolving coverage options are being introduced, but the challenge remains: risk is rising faster than most safety nets can adapt.

Some new tools—like area-based coverage, revenue protection options, or emerging specialty crop insurance—are helping. But without infrastructure improvements and smart planning, producers remain vulnerable to weather they can’t predict or control.

Mitigation & Future Outlook

To reduce rising crop insurance claims—and the associated downtime and financial risks—agriculture needs to evolve from reactive to proactive. Farmers, insurers, and service providers can collectively shift the landscape through three key approaches:

Enhanced Farm Practices & Infrastructure

- Regenerative and Conservation Agriculture: Practices like cover crops, residue management, and rotational grazing improve soil health, reduce erosion, and enhance water infiltration—reducing the severity of crop losses.

- Infrastructure Investment: Maintaining and upgrading grain bins, silos, drainage systems, and sorting equipment helps prevent infrastructure failures that often coincide with weather events and lead to insurance losses or costly salvage operations.

Innovative Insurance Solutions

- Index-Based Insurance Models (Parametric Insurance): Offers faster payouts using satellite or weather triggers, streamlining claims and reducing basis risk—especially when paired with remote sensing tools like NDVI.

Preparedness & Strategic Planning

- Emergency Action Plans (EAPs): Localized, farm-specific EAPs help producers know when and how to secure crops and facilities before, during, and after extreme weather—reducing damage and accelerating insurance claims recovery.

- Technology-Forward Tools: Early-warning systems, soil moisture monitoring, and weather-trigger alerts empower farmers to act proactively—minimizing loss and insurance exposure.

Why You Should Care

Farmers

Lower premiums, fewer downtime days, and enhanced long-term yield stability.

Insurers

Reduced claim frequency, smoother risk profiles, and improved profitability.

Communities

Stronger, more durable farm infrastructure supports local economies even after severe weather.

How West Side Salvage Can Help Reduce Claim Costs

While crop insurance provides critical financial protection, preventing and minimizing losses remains the most effective way to reduce overall costs for both farmers and insurers. West Side Salvage supports this by keeping grain silos and storage structures safe, functional, and compliant through proactive maintenance, thorough inspections, and fast-response after severe weather events.

For farmers, this means protecting harvest quality, reducing operational downtime, and avoiding major claims that impact future premiums. For insurers, it translates to fewer large-scale payouts and more resilient policyholders. Our Emergency Action Plan (EAP) services also ensure farms are prepared with clear safety protocols to manage risks effectively when disaster strikes.

Takeaway: West Side Salvage supports infrastructure investment through grain bin and silo maintenance services.

Conclusion

With more frequent extreme weather and an evolving insurance landscape, both farmers and insurers are feeling the strain of rising crop insurance claims. From expanding policy types to greater financial exposure, the need for reliable, responsive support has never been more important.

West Side Salvage stands at the intersection of agriculture and insurance—working alongside both producers and insurers to ensure faster recovery, clearer documentation, and safer infrastructure. Whether it’s maintaining a grain bin before storm season, salvaging damaged commodities, or preparing Emergency Action Plans (EAPs), our goal is the same: help reduce risk, streamline response, and support long-term resilience.

References

- American Farm Bureau Federation. (2024). Hurricanes, Heat and Hardship: Counting 2024’s Crop Losses.

- USDA Economic Research Service. (2023). Drought Was the Leading Cause of Crop Insurance Indemnities in 2022.

- Neeley, Todd. (2023). EWG Shows Higher Crop Insurance in Area of Prevent Plant.

- Environmental Working Group. (2023). Farmers Received Record $19.13B in Crop Insurance Indemnities in 2022.

- Environmental Working Group. (n.d.). Crop Insurance Analysis.

- USDA Economic Research Service. (2023). Revenue Protection Was the Most Used Type of Crop Insurance in 2022.

- Stanford Woods Institute for the Environment. (2022). Global Warming Increased U.S. Crop Insurance Losses by $27 Billion in 27 Years.

- USDA Risk Management Agency. (2024). 2024 Expansions for Specialty Crops.

- U.S. Government Accountability Office. (2024). Crop Insurance: Information on Program Cost and Performance.

- Iowa State University Extension and Outreach. (n.d.). Crop Insurance—Revenue Protection.

- U.S. Department of Agriculture. (2022). Climate Change and the Federal Crop Insurance Program.

- Environmental Working Group. (2023). Crop Insurance Pays Farmers Billions of Dollars for Weather-Related Losses Closely Linked to Climate Change.

- Mehrabi, Zia, et al. (2025). The Cost of Climate Change on Crop Insurance. Natural Hazards and Earth System Sciences, 25(4), 913–932.